Editor’s Note: William Powhida is mean. His acerbic drawings and calculated rant-pieces have built him a reputation in New York’s art world as something between a complicit skeptic and a doomsday preacher, decrying the ills of contemporary art even as he steadily climbs its ladder. Last month, he opened a show at Postmasters Gallery – up until November 26th – that turned that same eye onto high finance, politics, and the general state of everything. I visited him in his studio to find out more.

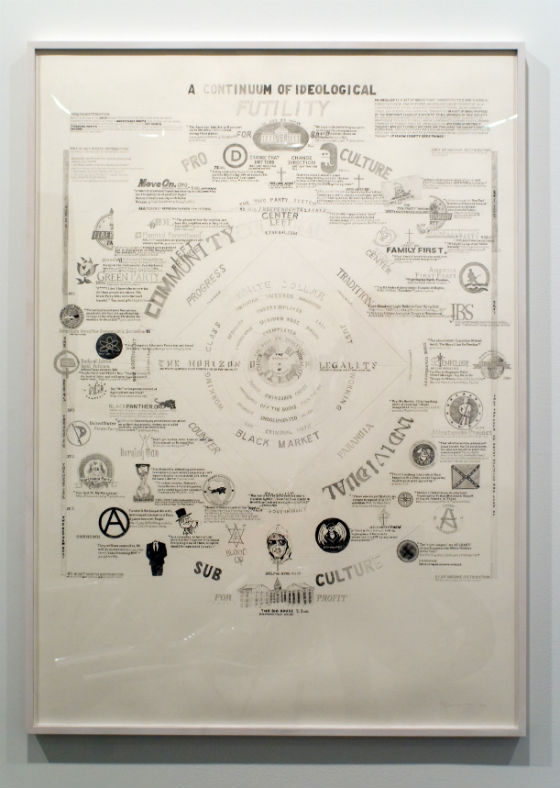

Will Brand: What's this?

William Powhida: This piece is A Continuum of Ideological Futility, where the cultural focus is overlapped with economic focus — sort of two legs of any ideology. Most of the quotes are tweets, from either the organization itself, or around a hashtag, or from an active member of the community… These are subcultures and countercultures, where people stopped giving a shit about the system, stopped participating in democracy, where they just take their gun and move into the woods.

Essentially, in this, I've created a twitter feed: it's Obama, the Democrats, House Republicans, the Ayn Rand Center, and then seven tweets from “Old Salty Crip Ass” saying, “I'm going to dot that bitch's eyes.” I'm trying to get the full range of ideological tweets, which can be utterly boring, a lot of re-tweeting crap.

WB: Why tweets?

WP: The show's called Derivatives, so everything borrows from something else. Things are derived from Twitter, or from a book, or from a previous work I'd done that was itself based on a Wikipedia page, the entry on the economics of art and literature- which is woefully short.

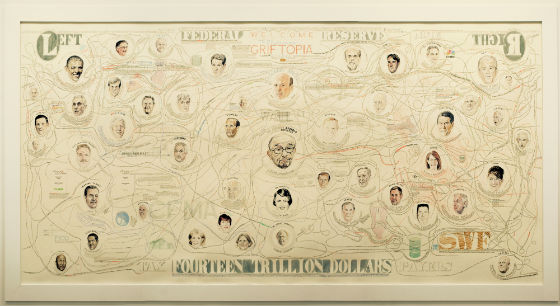

WP: [Griftopia] is the main piece for the show. It's based on Matt Taibbi's book Griftopia, although it's more representative of my own confusion. I was really interested in the book, which looks at the collapse of the monetary system but takes on a number of things besides just the economics of it.

WB: So these are all quotes from the book?

WP: I think there are a few things I've paraphrased or ad-libbed, but for the most part, Griftopia is just verbatim from the book. What I found fascinating about Taibbi is that he's trying to [describe the financial crisis] in layman's terms and explain things in a way that might make sense to the average reader – or an idiot artist like myself. Most of this stuff, I really don't really know how it works.

My interest in [the financial markets] really stemmed from 2004, when my brother called me and said, “I'm a loan officer.” He described to me the process of refinancing peoples' homes, giving out mortgages. When he described to me these ninja loans — “no income, no employment, no problem” — it quickly became apparent that it couldn't work. I was just like, “This doesn't seem rational in any way.” He got in at the tail-end of that – 2005, 2006. He never made a ton of money, because they'd already pillaged so much. But I watched that company sink overnight in maybe mid-2006. Everyone in that company, maybe 125 people, was fired overnight – it shrank to maybe 13 employees. Then, when the economic collapse hit in 2008, it was over.

WB: These quotes go back. This is from, when, '98?

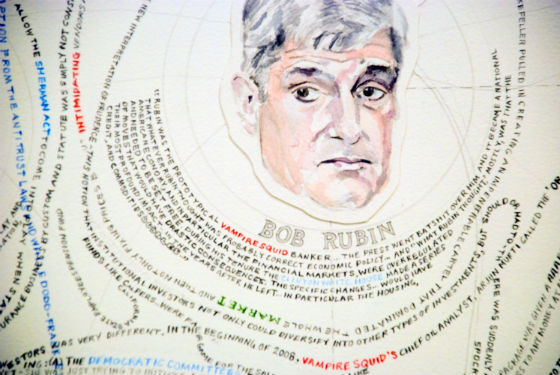

WP: Yeah, it goes back to Bob Rubin, Larry Summers – Clinton's economic team, who basically said, “Look, we have these laws that go back to the Great Depression, and we have to compete in the global economy, so we're going to deregulate all of these things” – or as they said, “set up new regulations.” So Gramm-Leach-Bliley came along and repealed the Glass-Steagall Act. Of course I don't think anyone would have used the term “repeal regulations” at that time; as Larry Summers said it, “Today Congress has voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the twenty-first century.” But the system was there for a reason – there was ton of speculation and bubbles created leading up to the Great Depression, and those laws were a safeguard. They were peeled away in the late nineties, and you have people like Brooksley Born, who were there writing concept drafts suggesting that they consider regulating the derivatives market.

There's a whole chapter on how these interconnected problems all trace back to Greenspan's economic policies. The narrative Taibbi weaves together is that whenever a bubble would burst, instead of the market actually correcting itself in some more obviously hideous way – companies going under, a lot of investments being lost — Greenspan would lower interest rates or make money available, pretty much throughout his entire tenure. He organized the bailout for Long Term Capital Management personally. For certain other companies, he said, “Nah, we're not going to bother with it,” but in general, it happened so often that it was called “The Greenspan Put.” Companies on Wall St. knew that if they fucked up that bad, Greenspan would step in and put more money into the system so they could keep going. It was a cycle of gambling that kept looping around. Taibbi's book takes on the Tea Party and this call for deregulation and letting the markets work, and as he says, it could potentially work, if you didn't have one guy saying “Let's deregulate and let the market work,” but still selectively bailing everybody out whenever shit gets real. He's tracing it back to the Randian mindset of complete deregulation, the idea that there should be no governmental involvement in anything other than defending its people against force. So he pretty much shits on Ayn Rand for a good portion of the chapter, which is titled “The Biggest Asshole in the Universe,” in reference to Greenspan.

Taibbi's very derisive, he attacks in his writing. I mean, who couldn't love a book with a chapter called “The Biggest Asshole in the Universe”? It's like, “Here's my perspective, I'm going to tell you about it,” and it really seemed to line up with the attacking mode of my work. I am still thinking about the idea derision as a useful model, rather than just talking about cynicism. It's kind of just a fucked up way of talking about being a critic.

WB: You actually were a critic for a while, right?

WP: Yeah, for about three years.

WB: I can also see how this makes your work about the art world look a lot better. (laughter) I've heard people criticize you for lacking some element of novelty, like you were just somebody who's sick of the art world, and it's like, “Cool, lots of people are sick of the art world.” But to take that same analytical mode and apply it to something else is important. You couldn't talk about derision or cynicism, anything larger than an attack on one subject, until you got to two subjects. Now we can see the patterns and go, “OK.”

WP: That's been something I've been hoping to do with the work. Since it grew out of being an art critic and being an artist, and being a teacher, and wondering, “Is this it? I'm going to be teaching full-time? This is a nightmare!”, it was hard to get away from talking about the experience of experiencing the art world, how with each rung, there's more insanity and absurdity to it.

WB: So does this work have an aim?

WP: I think the aim is to represent the complexity and my own internal struggle with trying to make sense of all of this, to figure it out for myself.

WB: Right, because you've done things [elsewhere] that are very nicely outlined with bullet points, and this doesn't seem like that.

WP: No, it's not, because I don't think there's any way to summarize it — the book tries, but there are still some gaping holes. I don't think there's any way to summarize it. Even if you could identify and articulate the problem exactly, there are still people who would just disagree fundamentally because it doesn't line up with their ideological position. So whatever the facts are, you can try to sort those out, but then you have to get into the intentions. Like, was Joe Casano at AIG never planning to pay these off? Was this just a fucking scam to make money? Did these guys just find these loopholes where there's no regulation and give each other money through derivatives transactions? That's the part where there's this argument that goes around.

{ 4 comments }

Can you make a single-page version of this? Thanks!

this is incomprehensible, and unlikely to have any practical effect — just like most contemporary art!

Dude you write about art all day and this is the best you got?

More substantially:Â

Of course Powhida’s show is “unlikely to have any practical effect”. Everyone from Picabia to Oscar Wilde has called art useless, and most of them have recognized that this is not a definitive fault. There exist reams of text on the topic of why contemporary art is so useless, if you’re interested, though I get that understanding might lack the self-satisfaction of contempt. In any case, I can recommend a number of good design blogs if that’s what you’re looking for.Â

Besides which, Powhida spends a large part of the interview you’re commenting on saying explicitly that his art is unlikely to have any practical effect. He says that he “doesn’t know what to do”, that “it’s futile”, that “it’ll either be interpolated by the art world and sucked up into the apparatus, or the market just [won’t] give a shit”, that “Even if you could identify and articulate the problem exactly, there are still people who would just disagree fundamentally because it doesn’t line up with their ideological position.” He repeatedly mentions the circularity of the arguments he’s entering into, and the slim chances of changing that. Even if you were to read nothing more than the image at the very beginning of the interview, you would have noticed it’s titled A Continuum of Ideological Futility.Â

I agree that most of Powhida’s subject matter is, in some sense, “incomprehensible”. I think he got that across when he said he “doesn’t really know how it works”, and when he stated that his goal was “to represent th[at] complexity.” That said, I feel like your comprehension problems might run deeper than that.Is there any particular point in the interview I can clarify? I have seven thousand-odd cut words sitting around in a Google doc, so I can almost certainly shed some light on anything that was left unclear, if you have a specific question.

Comments on this entry are closed.